(Bloomberg) -- Alcoa Corp., the storied US metals producer, is feeling the pinch of President Donald Trump’s tariffs and has been forced to pause work on all its growth projects underway in Canada.

Most Read from Bloomberg

-

The Dutch Intersection Is Coming to Save Your Life

-

Mumbai Facelift Is Inspired by 200-Year-Old New York Blueprint

-

How San Jose’s Mayor Is Working to Build an AI Capital

-

Advocates Fear US Agents Are Using ‘Wellness Checks’ on Children as a Prelude to Arrests

-

LA Homelessness Drops for Second Year

If the levies stay in place, Chief Executive Officer Bill Oplinger warns that the American manufacturer may need to turn to the Canadian government for help.

For now, Oplinger said he’s waiting until Aug. 1 — the negotiation deadline for a new economic and security deal between Canada and the US — to decide whether Alcoa will push for assistance from the Canadian government, financial or otherwise, to support the aluminum operations the company has in Quebec.

“The profitability of Quebec is severely impacted,” Oplinger said in a Friday interview. “The longer this goes, the more damage it will do to the competitiveness of the Quebec assets. And the Canadian government understands that.”

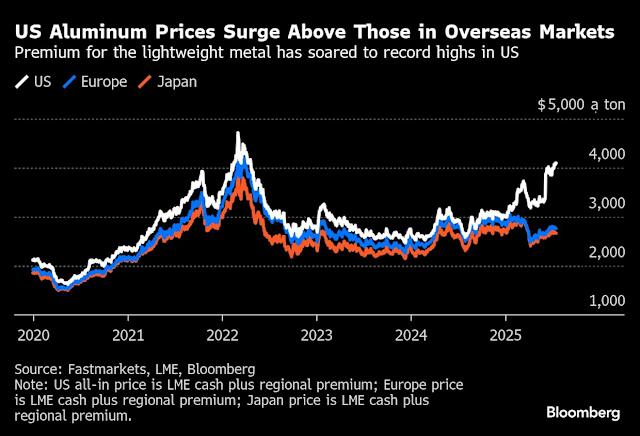

Alcoa’s challenges show how US levies on aluminum, aimed at boosting American manufacturing, are now hurting the largest US producer of the metal used in everything from soda cans to cars.

While Pittsburgh-based Alcoa has a lot of domestic production, it also depends on operations in Canada to meet demand. The company owns three smelting and casting facilities in Quebec that largely feed American customers. The firm is typically one of the largest suppliers to the US, but is now rerouting cargoes because of the levies.

“We’re doing everything we possibly can to ship tons that are normally destined for the US to other parts of the world,” Oplinger said.

Oplinger’s comments follow an earnings report on Wednesday that revealed Alcoa paid an additional $115 million in tariff-related costs in the second quarter. The company could look into lobbying both Canada’s federal government and the Quebec government for support if tariffs stay in place.

The firm is among many metal producers navigating trade tumult after the Trump administration raised US import tariffs on steel and aluminum — first to 25% in March, and then to 50% in June. Rio Tinto Plc said Wednesday that its Canadian-made aluminum generated costs of more than $300 million in the first half due to tariffs. The company also told local media in June that it implemented a hiring freeze at smelters across Quebec.

Story ContinuesAlcoa’s executives are now “looking very hard at capital investments” in Quebec, Oplinger said. “The plans we had for growth projects in Quebec are on hold until we have some resolution on the tariffs.”

Nearly 40% of Alcoa’s metal produced in Quebec can be diverted to non-US customers, mostly in Europe and elsewhere in Canada, though weakened demand overseas has hampered the prospects for producers to reroute shipments entirely.

The company has warned it could face further tariff costs if Trump follows through on threats to place 50% tariffs on Brazil, where Alcoa sources alumina to feed its US plants. Oplinger said he’s now deciding whether to preemptively source alumina outside of Brazil in anticipation of those prospective levies.

The Alcoa executive was appointed CEO in 2023 after serving as the firm’s Chief Operations Officer and, previously, Chief Financial Officer.

“I’ve been with Alcoa for over 25 years and I think this is easily the most extreme trade uncertainty we’ve seen,” he said on Friday.

--With assistance from Mathieu Dion.

Most Read from Bloomberg Businessweek

-

A Rebel Army Is Building a Rare-Earth Empire on China’s Border

-

What the Tough Job Market for New College Grads Says About the Economy

-

How Starbucks’ CEO Plans to Tame the Rush-Hour Free-for-All

-

Godzilla Conquered Japan. Now Its Owner Plots a Global Takeover

-

Why Access to Running Water Is a Luxury in Wealthy US Cities

©2025 Bloomberg L.P.