Despite being one of the largest cannabis operators by market capitalization, shares of Green Thumb Industries GTBIF have been declining persistently over the past few years due to regulatory hurdles and intensifying competition.

While the company’s top-line growth seems encouraging, profitability remains under pressure from rising costs.

Let’s delve into the company’s fundamentals to gain a better understanding of how to play the stock amid this price decline.

Pricing Pressures on GTBIF’s Operations: A Woe

What sets Green Thumb apart from many peers is its vertically integrated model — cultivating, processing and selling cannabis through its own retail and wholesale operations. However, with 100% of the company’s revenues tied to U.S. markets, it remains highly exposed to domestic regulatory risks, particularly the lack of federal legalization, which continues to restrict access to capital and interstate commerce.

Green Thumb’s first-quarter 2025 top-line numbers rose just 1% year over year to $280 million. While the company’s consumer packaged goods (CPG) business delivered 14% year-over-year growth, the gains were partially offset by a 2.5% decline in retail segment sales due to price compression in existing markets. Sales of comparable stores (open at least 12 months) fell more than 5% during the quarter, reflecting competitive pressure and softer consumer demand.

However, the company’s bottom line painted a more challenging picture. Despite the nearly flat sales, profitability came under strain. Gross profit margins during the quarter were 51.3%, down 80 basis points from the year-ago period’s level due to the pricing compression.

Meanwhile, selling and operating expenses rose 11%, and the company reported a sharply higher effective tax rate of 79% (vs. 51% in the year-ago period). These cost pressures contributed to a significant hit to net income and EPS, with GTBIF missing our consensus estimate.

Looking ahead, we expect Green Thumb to remain under pressure due to persistent pricing compression in maturing markets. Management has already flagged expectations for flat sequential revenue growth in the second quarter and noted that adjusted EBITDA margins are likely to remain below the 30% mark in the near term. While the company continues to prioritize cash flow and prudent cost management, margin expansion could remain elusive without meaningful regulatory reform or a rebound in retail pricing dynamics.

Stiff Competition From Other Cannabis Players

Green Thumb is targeting an overcrowded market. It faces stiff competition from its peers — Aurora Cannabis ACB, Cresco Labs CRLBF and Curaleaf Holdings CURLF — all of which are also pursuing similar expansion and cost-optimization strategies, making the competitive landscape even tougher.

Story ContinuesCompanies like Aurora Cannabis and Curaleaf Holdings are also expanding their footprints beyond geographic borders, in markets like Europe and Australia. This international exposure gives them an edge over Green Thumb and Cresco Labs, who remain fully dependent on an increasingly saturated and fragmented U.S. market.

GTBIF Stock Performance and Estimates

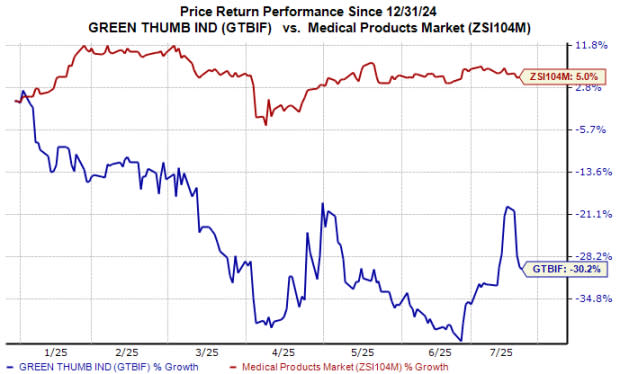

Shares of Green Thumb have declined 30% year to date against the industry’s 5% growth, as shown in the chart below.

Image Source: Zacks Investment Research

While EPS estimates for 2025 have declined slightly, the same for 2026 have been stable over the past 60 days.

Image Source: Zacks Investment Research

How to Play GTBIF Stock?

While a stable revenue stream and ability to generate free cash flow offer some support for GTBIF stock, the stock remains exposed to significant domestic headwinds. However, the company’s significant exposure to the domestic market, combined with rising costs and margin pressures, continues to strain its financial profile. Without a major shift in federal policy or a recovery in retail pricing, meaningful upside appears limited.

With its earnings trajectory under pressure and no international diversification to help offset domestic headwinds, the investment case for GTBIF remains weak for risk-averse investors. A Zacks Rank #4 (Sell) further reflects that the stock offers limited upside and elevated risk for conservative investors.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aurora Cannabis Inc. (ACB) : Free Stock Analysis Report

Green Thumb Industries Inc. (GTBIF) : Free Stock Analysis Report

Cresco Labs Inc. (CRLBF) : Free Stock Analysis Report

Curaleaf Holdings, Inc. (CURLF) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research