It's a lollapalooza week ahead for markets originally appeared on TheStreet.

Updated: 2:48 p.m. EDT Sunday

Stocks, weak already, slumped badly in early April because players in global financial markets basically threw up when they saw the first Trump Administration tariff proposal.

Within a week, the administration backtracked, letting the market bottom. It has rebounded strongly as the Administration actually negotiated term sheets (if not actual deals) that will result in tariffs running about 15%.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰

Meanwhile, market prices stabilized, and investors swooped in because what lay before traders was a giant bucket of bargains.

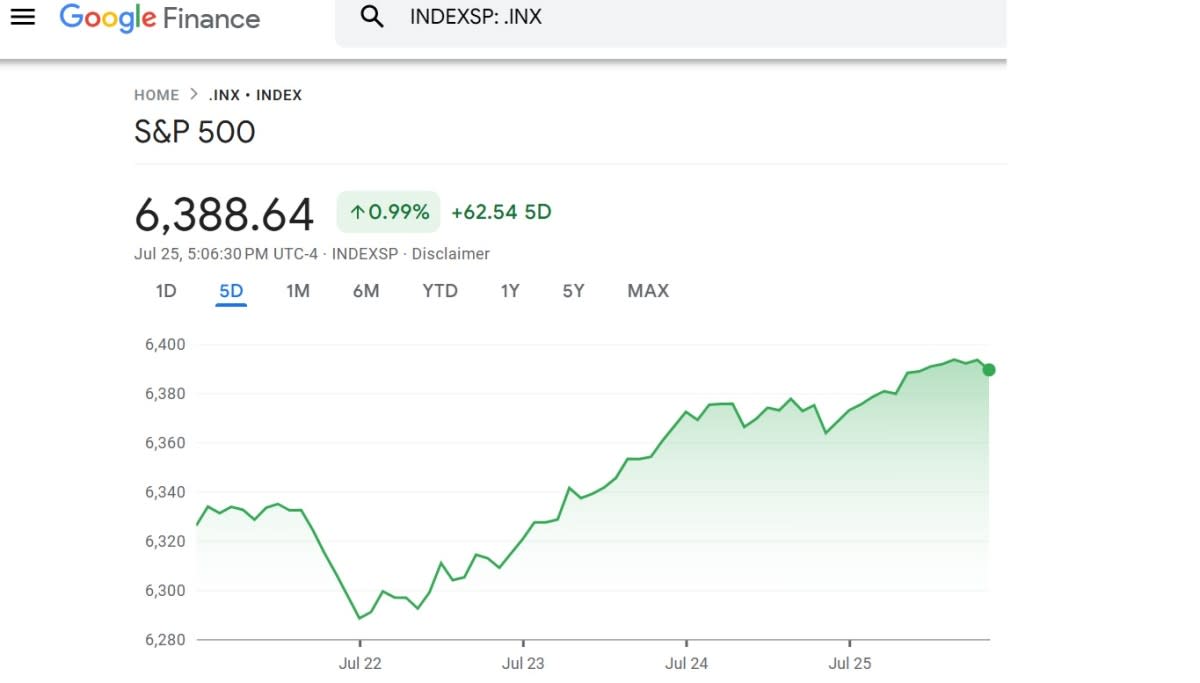

The result, as of Friday, was that the Standard & Poor's 500 Index has jumped 32% since the April panic.

Related: Microsoft CEO says company's mission needs to change

The index ended this past week with five straight record closes and hit 52-week highs every day except Tuesday.

The Nasdaq Composite and Nasdaq-100 indexes have gained 43% and 41%, respectively from their April lows while hitting new highs during this week. The Dow Jones industrials have climbed 23%.

Some risks to watch

There are many who see the market surging from here, thanks primarily to tax cuts and deregulation. (That was their outlook after President Trump's election, and there's talk the S&P 500 will top 7,000 by year end.

There are still risks, however. The domestic economy is not that robust. Corporate layoffs keep happening. The housing market is stagnant; tech jockeys often forget that residential real estate is a powerful — if quiet — source of retail sales. And, of course, global and domestic politics are volatile.

President Trump is frustrated Russia won't stop its war with Ukraine. He's livid Federal Reserve Chairman Jerome Powell won't take direction and cut interest rates.

Moreover, the rally since April has been so robust that the S&P 500, Nasdaq and Nasdaq-100 are all showing relative strength indexes at above 70, a signal the stock market is becoming overbought.

The RSI for shares of chocolate-candy maker Hershey (HSY) is at 71. Caterpillar (CAT) is at nearly 79. Alphabet (GOOGL) , which reported strong earnings this past Wednesday, is at 73.6. Microsoft (MSFT) , due after this Wednesday's close, is at 72.

The market could just be tired. The S&P 500 is up 3% in July, but it finished up 5% in June and 6% in May. The Dow and Nasdaq also may be losing some momentum as well.

Story continuesRelated: AARP CEO sounds the alarm on Social Security

One of the biggest weeks for earnings

The rally fever feeds into this week, which will see some 843 companies report quarterly results. The reports and investor reactions will hint at what happens next.

The earnings-release schedule includes post-close reports from Microsoft and Facebook-parent Meta Platforms (META) on Wednesday and Amazon.com (AMZN) and Apple (AAPL) on Thursday.

Each of these four, all members of the Magnificent Seven group of stocks, have market capitalizations of more than $1 trillion. (Microsoft's is $3.8 trillion.) They represent about 20% of the entire market capitalization of the S&P 500. The other Mag 7 stocks are Alphabet, Tesla (TSLA) , both of which reported last week, and Nvidia (NVDA) , due Aug. 27.

Meta and Microsoft are expected to show revenue gains of around 14% from a year ago and earnings gains of 13%-to-14%. Amazon should show similar gains. Apple, which has struggled and is down 14.6% this year, may show a 3.7% revenue gain to $88.9 billion and earnings of $1.42 a share, up slightly from a year ago.

Among reports also due this week are:

-

Waste Management (WM) , Cadence Design systems (CDNS) and Whirlpool (WHR) (Monday).

-

Credit-card giant Visa (V) , consumer products giant Procter & Gamble (PG) , UnitedHealth Group (UNH) , Boeing (BA) and Starbucks (SBUX) (Tuesday).

-

Chip designer Arm Holdings (ARM) , Qualcomm (QCOM) and Ford Motor (F) (Wednesday).

-

Mastercard (MA) and crypto enthusiast MicroStrategy (MSTR) and (Thursday).

-

Oil giants Exxon Mobil (XOM) and Chevron (CVX) (Friday).

In addition, economic reports will command a lot of attention, especially this week's meeting of the Federal Open Market Committee, which sets the Fed's short-term interest rates.

Overall, the second-quarter earnings should be OK. FactSet, the analytics company, says 34% of S&P 500 companies have reported second-quarter results, with 80% of companies beating estimates. But FactSet thinks growth rates may slip a little for the second quarter and the rest of 2025.

More Tariffs:

-

Luxury carmakers have a more aggressive tariff battle plan

-

Top 6 cars, SUVs, & trucks that may avoid tariffs, Consumer Reports says

-

Amazon’s quiet pricing twist on tariffs stuns shoppers

-

Levi's shares plan to beat tariffs, keep holiday prices down

Tariffs won't go away

The guidance will be a key metric for investors. Tariffs will start to hit on Aug. 1 to Aug. 7, around 15-to-19%. But these levels are better than 40% or 50% bandied about in April, but a 15% tariff rate would be the highest tariff since 1911, according to the Yale Budget Lab.

China and Canada are still trying to cut deals. The president announced Sunday that the European Union has agreed to 15% tariffs.

All of this assumes federal courts uphold the tariffs. If the administration wins, listen to how companies say they're planning for the tariffs. A hearing on whether the Administration can boost tariffs without Congressional approval is set for Thursday before the U.S. Circuit Court of Appeals in Washington D.C.

Related: Where's the inflation? Not in stores — yet

One interested party is Hershey, producer of Hershey's bars, Hershey Kisses, Reese Cups and KitKat bars. The company said this week it will raise prices in the "low single digits" because chocolate can't be grown in the United States, and droughts in west Africa have caused raw cocoa prices to soar. Tariffs won't help.

Hershey shares have jumped 19% from their April low. The company reports second-quarter results before Wednesday's open.

Amazon.com also has moved prices higher, and prices for high-end European-built sewing machines are expected to rise as well. And we haven't gotten to the BMWs of the world.

Boeing's a winner

Boeing is an unlikely winner from tariffs because many trade deals the Administration has announced (which are really agreements to agree) include airliner purchases from Boeing, one of two manufacturers of wide-body jets. It's assumed it won't pay big tariffs from bringing components into the United States.

Orders for hundreds of Boeing jets have been announced in deals with Indonesia and Japan this month, as well as Bahrain, the United Arab Emirates, Saudi Arabia and Qatar earlier in the year, The New York Times noted.

Investors have been delighted. The shares briefly dropped under $129 on April 7. With Friday's close of $233.06, the shares are up 81% since. For the year to date, Boeing is up 31.7%.

Related: Veteran fund manager points to glaring problem with stocks after rally

It's a lollapalooza week ahead for markets first appeared on TheStreet on Jul 27, 2025

This story was originally reported by TheStreet on Jul 27, 2025, where it first appeared.

![White Spots on Screen Android [Fixed With Quick Steps 2024]](http://paseban.com/zb_users/upload/2025/08/20250831074647175659760769544.jpg)