(Bloomberg) -- Not long ago, Donald Trump could rattle Wall Street for days with a single post. Now, he threatens to oust the world’s most powerful central banker, and Treasury yields barely twitch. Stocks continue their steady climb. Haven assets hardly stir.

Most Read from Bloomberg

-

The Dutch Intersection Is Coming to Save Your Life

-

Mumbai Facelift Is Inspired by 200-Year-Old New York Blueprint

-

How San Jose’s Mayor Is Working to Build an AI Capital

-

Advocates Fear US Agents Are Using ‘Wellness Checks’ on Children as a Prelude to Arrests

-

LA Homelessness Drops for Second Year

This quiet isn’t simply the result of summer trading lulls, it reflects something deeper. For all the political noise and recession warnings, the US economy refuses to buckle — and markets, against the odds, are behaving rationally.

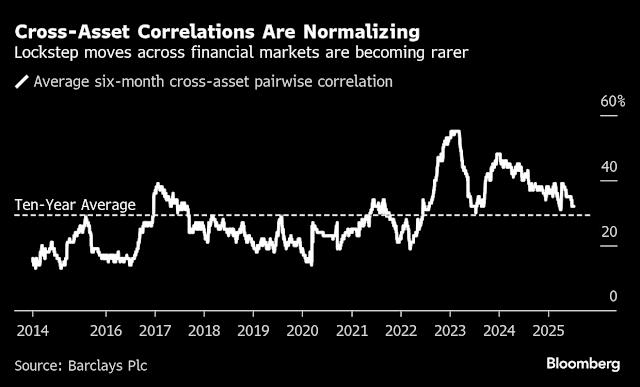

One way to see this is through the lens of cross-asset correlations: the degree to which equities, bonds, credit and commodities move in sync. That alignment — a fact of market life for the past three years as inflation and Federal Reserve policy monopolized headlines — has faded back to its 10-year average.

Where high-yield bonds once tracked short-term Treasuries tick for tick, they now trade with greater independence. Equities have decoupled from interest rates. Gold has reemerged as a diversifier, detached from Treasuries and credit. And all this as a resilient corporate-earnings season gets underway.

In financial terms, this is what a functioning economy looks like, one in which no single variable dominates. Correlations weaken when inflation no longer terrifies and traders focus on real-world fundamentals beyond policy machinations. Add in a view that Trump is bluffing on trade — and suddenly, markets aren’t obsessed with just one theme.

“Despite all the macro anxiety, growth is stable and resilient so far, and rates volatility has subsided, so equity markets are more driven by idiosyncratic factors,” said Barclays Plc strategist Emmanuel Cau.

Put another way, equities are responding to earnings, not broad economic concern. Risk premiums for corporate debt are reflecting balance sheets, not just central bank signaling. And that means markets aren’t ruled by fear, they’re showing internal logic.

Investors’ capacity to tune out drama was on full display this week. Even as Trump lashed out at Fed Chair Jerome Powell and central bankers aired diverging views on rates, markets stayed calm. The S&P 500 rose 0.6%, logging a 17-day streak without moves over 1 percentage point in either direction. A long-duration Treasury ETF slipped 0.6%. Bitcoin hovered near record highs.

Story ContinuesMuted reactions have pushed a measure of co-movement between assets tracked by Barclays back near levels last seen before the Fed began its rate-hiking campaign three years ago. The gauge, which focuses on pairwise correlations between government bonds, credit, stocks and commodities, surged to a record 55% in March 2023, when inflation-fueled lockstep moves were punishing investors across assets. Now, it’s at 32%, roughly the average of the past decade.

“Markets survived a ‘near-death’ experience in April after the president reversed course. Investors believe he’s afraid of the stock market and does not have the nerve to follow through on market-adverse policies,” said Michael O’Rourke, chief market strategist at JonesTrading LLC. Now they’re “embracing risk in all corners of the financial markets.”

Judging by headlines alone, now may seem like a strange time for normalcy to break out. There’s been no shortage of short-lived market shocks, from abrupt tariff threats, currency volleys, political tension at the Fed. What’s changed isn’t the noise, but how markets absorb it. The S&P 500 has surged 26% since the April lows while Bitcoin has soared more than 50%.

A relentless rally in risk assets — despite tariff threats and economic unease — has helped break asset linkages. But in markets this calm and rational, any real shock risks hitting harder.

In any event, it’s too early to celebrate bonds as an all-purpose hedging tool, say Wall Street pros such as AllianceBernstein’s Inigo Fraser-Jenkins. Too many big-picture irritants loom with the potential to hijack psychology in one swoop, among them inflation, government profligacy, climate, demographic shifts and deglobalization.

“The prognosis of structural upward forces on inflation level and volatility also imply that cross asset correlations remain high for years to come,” he said.

For now though, the correlation reset has soothed nerves for cross-asset allocators and revived faith in diversification. The 60/40 portfolio is up 6% this year while the Cambria Global Asset Allocation ETF tracking a portfolio of stocks, bonds, real estate, and commodities is up 9%.

With expectations of tamed inflation and resilient growth, the current regime leaves little margin for surprise.

“I would not get too comfortable with idea that inflation fears are gone for good. Higher inflation generally increases correlation, as it is the ‘enemy’ of most asset classes,” said James St. Aubin, CIO at Ocean Park Asset Management. “A fear of stagflation is really the outlook that creates high correlation between stocks and bonds.”

Most Read from Bloomberg Businessweek

-

A Rebel Army Is Building a Rare-Earth Empire on China’s Border

-

What the Tough Job Market for New College Grads Says About the Economy

-

How Starbucks’ CEO Plans to Tame the Rush-Hour Free-for-All

-

Godzilla Conquered Japan. Now Its Owner Plots a Global Takeover

-

Why Access to Running Water Is a Luxury in Wealthy US Cities

©2025 Bloomberg L.P.