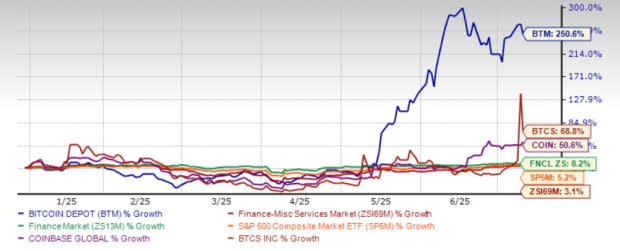

Bitcoin Depot Inc. BTM shares have skyrocketed 250.6% this year, significantly outperforming the industry, the Zacks Finance sector and the S&P 500 index. Additionally, the stock has performed extremely well compared with its close peers — Coinbase Global, Inc. COIN and BTCS, Inc. BTCS.

BTM YTD Price Performance

Image Source: Zacks Investment Research

Bitcoin Depot has benefited from rising demand for cryptocurrency, supported by regulatory tailwinds under the Trump administration. While the business remains mostly domestic, ongoing tariff concerns and geopolitical tensions may influence consumer sentiment and crypto demand trends, potentially weighing on growth. Can BTM stock continue to ride the crypto adoption wave, or will macroeconomic uncertainties limit its upside potential? Let’s find out.

Factors Supporting Bitcoin Depot Stock

Organic Growth Efforts to Support Revenues: Bitcoin Depot’s revenues have been growing in the past couple of years. Though the metric declined in 2024, it rose in 2023. Revenues continued to increase during the first quarter of 2025 on a year-over-year basis.

Bitcoin Depot has been driving revenues primarily through BTM Kiosks, which accounted for roughly 99.7% of its total revenues. As of March 31, 2025, it had 8,463 BTM Kiosks installed across the United States, Canada and Puerto Rico, with a median kiosk transaction size of $300.

In 2022, it launched BDCheckout, which allows customers to load cash into their accounts at the checkout counter at retailer locations and then use those funds to purchase Bitcoin. This enables Bitcoin Depot to increase its client base without incurring upfront hardware costs to set up kiosks and pay monthly rents. As of March 31, 2025, BDCheckout was available at 10,926 retail locations.

Bitcoin Depot aims to boost its BDCheckout retail transaction volume to reduce capital expenditures and revert to profitability. Also, it plans to capitalize on existing partnerships and new ones to expand its BTM Kiosks to drive higher transaction volumes, which in turn will boost revenues. It remains open to opportunistic expansions to scale its operations, given a fragmented BTM market. In sync with this, the company acquired the assets of Pelicoin, LLC last month to strengthen its presence in the Gulf South region of the United States.

During 2024, the company entered into seven franchise profit-sharing arrangements, under which counterparties will earn a share in profits generated by a particular group of kiosks. Also, it secured a deal with CEFCO for 72 out of their more than 200 locations to diversify within the convenience store industry. The company also signed a master placement agreement with EG America LLC, to install BTM kiosks in more than 900 locations.

Thus, these efforts are likely to drive Bitcoin Depot’s revenues higher and further aid its financials to move toward profitability as BDCheckout revenues continue to rise. As cash remains an integral part of the economy, the company has a large client base to acquire, aiding its revenues.

Sales Estimates

Image Source: Zacks Investment Research

Favorable Regulatory Norms to Boost Cryptocurrency Adoption: Bitcoin Depot is set to benefit from the Trump administration’s supportive stance toward cryptocurrency.

In May 2025, Paul Atkins, chair of the Securities and Exchange Commission (SEC), stated his plans to overhaul cryptocurrency policies and establish guidelines for the distribution of crypto tokens that are securities, and consider whether additional exemptions are necessary.

In March 2025, the Federal Deposit Insurance Corporation (FDIC) clarified that FDIC-supervised institutions can engage in permissible crypto-related activities without receiving prior approval. Further, Donald Trump signed an executive order to establish a strategic crypto reserve.

These developments signify that the cryptocurrency space is likely to experience higher demand as countries embrace it and will likely be integrated into legal payment structures, favoring firms like Bitcoin Depot, Coinbase and BTCS to tap into the huge opportunity to expand.

Solid Balance Sheet: As of March 31, 2025, Bitcoin Depot's cash and cash equivalents were $35 million. It had a debt (including notes payable, current and non-current portion) of $55.5 million as of the same date.

In 2023, the company authorized a share repurchase plan to buy back up to $10 million worth of shares, which expired on March 31, 2025. The company doesn’t pay dividends as it intends to reinvest most of its earnings to expand ongoing ventures.

Thus, a strong liquidity sheet position will likely enable the company to sustain its share repurchase program in the future.

Bitcoin Depot Stock Undervalued

In terms of valuation, Bitcoin Depot’s 12-month forward price-to-earnings ratio (P/E) of 11.78X is lower than the industry's 21.63X. Thus, the stock is trading at a discount. This suggests that investors may pay a lower price than the company's expected earnings growth.

12-month Forward P/E Ratio

Image Source: Zacks Investment Research

On the other hand, Coinbase and BTCS have a 12-month forward P/E ratio of 77.12X and 15.55X, respectively. This reflects that BTM stock is inexpensive compared with its peers.

To Buy or Not to Buy BTM Stock?

Bitcoin Depot is well-positioned for growth, given its leadership in North America in BTM kiosks and focus on BTCheckout to enhance operating leverage. Further, favorable regulatory developments, significant cash circulation in the economy and growing interest in cryptocurrency among investors as an asset class are other tailwinds.

Moreover, a solid balance sheet position suggests financial stability. It will enable BTM to continue its repurchase plans. Discounted valuation is another positive.

Over the past month, the Zacks Consensus Estimate for Bitcoin Depot’s 2025 and 2026 earnings of 46 cents and 51 cents per share, respectively, has remained unchanged.

Estimate Revision Trend

Image Source: Zacks Investment Research

The projected figures imply year-over-year earnings growth of 176.7% and 10.3% for 2025 and 2026, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

However, a persistent increase in expenses is a headwind. Operating expenses recorded a 26.5% jump in 2023 due to higher sales and marketing and revenue-related costs, while expenses declined 4.7% in 2024. The uptrend continued during the first three months of 2025 on a year-over-year basis. Overall expenses are expected to be elevated as the company intends to expand its kiosk network as it expands into different markets.

Also, the company operates in a highly regulated industry and is exposed to regular probes and litigations, which can create friction in operations and even hurt financially, if hefty fines are imposed. In February 2025, BTM’s subsidiaries were sued by the Iowa Attorney General for allegedly failing to prevent fraudulent use of their ATMs under the Iowa Consumer Fraud Act. The company denied the allegations and is defending the case. Also, intense competition from Coinbase and BTCS can hurt its pricing power.

Thus, Bitcoin Depot stock remains a cautious bet for investors. Those who own it can continue holding the stock for long-term gains.

Currently, BTM carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bitcoin Depot Inc. (BTM) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

BTCS Inc. (BTCS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research