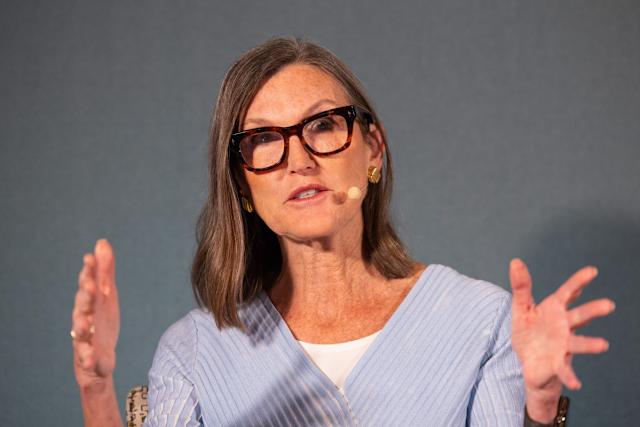

Cathie Wood, who dumped surging stock, calls it crypto’s ‘ChatGPT moment’

Cathie Wood, who dumped surging stock, calls it crypto’s ‘ChatGPT moment’ originally appeared on TheStreet.

ARK Invest CEO Cathie Wood is a strong advocate of cryptocurrencies whose firm keeps investing in crypto-focused stocks such as Coinbase (Nasdaq: COIN), Circle (Nasdaq: CRCL), and Robinhood (Nasdaq: HOOD).

Circle, which went public on June 5, is among the hottest stocks in the market right now.

Wood recently said she agreed with Fundstrat Global Advisors Head of Research Tom Lee that Circle's IPO is the "ChatGPT moment" in crypto. She was talking to BanklessHQ on July 8 when she made the remarks.

Circle is a crypto company that issues the USDC stablecoin.

A stablecoin is a type of cryptocurrency that attempts to stabilize its value, unlike traditionally volatile cryptocurrencies such as Bitcoin.

With a market cap of $61.67 billion, Circle's USDC is the second-largest stablecoin and accounts for nearly 25% of the total stablecoin market cap of $255.46 billion, as per DeFiLlama.

Institutions studying crypto hard

Since its Apr. 5 launch, the CRCL stock has soared as much as 600%. Wood hailed the Circle IPO for spurring a shift in how institutional investors approach crypto assets.

ARK Invest CEO positioned the Circle IPO in a long line of events in the short history of the crypto industry.

Wood said that earlier, fund managers approached institutional investors with a disclaimer that they "may not like this thing called crypto," but it's a new asset class.

Join the discussion with Scott Melker on Roundtable here.

Though the introduction of Bitcoin exchange-traded funds (ETFs) in January 2024 secured more audience for fund managers, the Securities and Exchange Commission (SEC) going aggressively after the crypto industry didn't help, Wood added.

The new U.S. administration brought a complete change in regulatory policy toward crypto, and then Circle went public, she added.

Story ContinuesInstitutions are now studying crypto hard, and they can't miss out on the equivalent of artificial intelligence (AI), the convergence of AI and crypto leading toward AI agents, and the threat posed by decentralized finance (DeFi), Wood added.

The fund manager also hailed Robinhood for launching tokenized stocks, layer-2 blockchain, perpetual futures, and staking.

On June 22, Cathie Wood’s ARK Invest has offloaded $146 million worth of Circle stock as CRCL surged 248% since its IPO. Despite the selloff, ARK remains Circle’s 8th-largest shareholder with $750 million still held across funds. The move marks ARK’s third major dump this week amid growing momentum in stablecoin adoption.

Cathie Wood, who dumped surging stock, calls it crypto’s ‘ChatGPT moment’ first appeared on TheStreet on Jul 9, 2025

This story was originally reported by TheStreet on Jul 9, 2025, where it first appeared.