Cloudflare vs. Fastly: Which Stock Has the Edge on CDN Space?

Cloudflare NET and Fastly FSLY are both leading the content delivery network (CDN) space. While Cloudflare focuses on global expansion strategy, Fastly focuses on high-performance, programmable content delivery network. Both Cloudflare and Fastly are expected to gain from the rapidly expanding CDN space, which is expected to witness a CAGR of 18.04% from 2025 to 2034, per a report by Precedence Research.

With this strong industry growth forecast, and given Cloudflare and Fastly’s superior position in the CDN market, the question remains: Which stock has more upside potential? Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which offers a more compelling investment case.

The Case for Cloudflare Stock

Cloudflare’s CDN provides a globally distributed, high-performance platform that speeds up content delivery, all the while keeping secure web connectivity. Cloudflare uses methods like tiered caching, Argo smart routing, and cache reserve to minimize traffic and optimize delivery efficiency.

Cloudflare’s CDN supports advanced protocols, including HTTP/3, and offers developer flexibility through Cloudflare Workers. Cloudflare Workers lets developers build, deploy, and scale applications across Cloudflare's global network. The company goes further to secure its clients with security tools, including DDoS, WAF, bot management, and automatic Secure Sockets Layer and Transport Layer Security.

However, since a substantial portion of the company’s sales is derived from outside the United States, the U.S. government’s aggressive stance on tariffs toward major economies is a concern for Cloudflare. NET also operates in a highly competitive environment. In the content delivery space, companies like Amazon, Akamai Technology and Radware in CDN space and Palo Alto Networks, Zscaler and Checkpoint in security space.

Competitive pricing strategies by NET’s competitors, its own heavy investments in sales and marketing to gain market share have contracted its margins. This is the reason why, despite rapid increase in revenues, NET’s bottom line is constricted. The Zacks Consensus Estimate for NET’s 2025 revenues is pegged at $2.09 billion, indicating year-over-year growth of 25.4%. However, the Zacks Consensus Estimate for NET’s 2025 earnings is pegged at 79 cents, indicating year-over-year growth of 5.33%.

Image Source: Zacks Investment Research

The Case of Fastly Stock

Fastly focuses on high-performance, programmable content delivery networks. Its Managed CDN gives its customers full control and flexibility by setting up dedicated servers inside their own private networks. It can be used alone or alongside multiple other CDNs in a hybrid setup.

Story ContinuesFastly provides its CDN platform as part of a comprehensive solution, which includes DDoS protection capabilities for protection from Layer 3 and 4 DDoS attacks, bot management, advanced rate limiting and Next Gen WAF. Other solutions like Media Shield enables large streaming companies using multiple CDNs to reduce duplicate content requests, making streaming faster, more efficient, and less demanding on infrastructure.

Fastly provides faster time to first byte compared to traditional cloud CDNs due to its high-capacity POPs and ultra-fast global purge times. The Fastly CDN reduces costs through features like Origin Shield and allows configurability through APIs, real-time log streaming, and seamless integration with CI/CD toolchains.

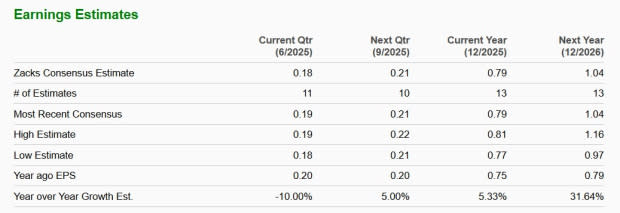

Although the CDN market is highly competitive due to its fragmented nature and presence of multiple large players, Fastly has carved its niche and is pursuing growth in that direction. The Zacks Consensus Estimate for Fastly’s 2025 loss is pegged at 9 cents, indicating year-over-year growth of 25%.

Image Source: Zacks Investment Research

Stock Price Performance and Valuation of FSLY and NET

In the year-to-date period, Cloudflare shares have climbed 69.5%, while shares of Fastly have plunged 26%.

Image Source: Zacks Investment Research

Cloudflare is trading at a forward sales multiple of 28.19X, while FSLY is trading at a forward sales multiple of 1.67X.

Image Source: Zacks Investment Research

Conclusion: NET vs. FSLY

Both companies are major players in the CDN space, but Fastly’s focus is on efficiency, added capacity, and high-throughput POPs that lower latency and cost. Fastly also wins in terms of greater configurability. With robust bottom-line growth expectations and comparatively lower valuation, FSLY has an edge over NET.

Currently, Fastly carries a Zacks Rank #3 (Hold), giving it an edge over Cloudflare, which has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fastly, Inc. (FSLY) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research