Nvidia-backed stock sends a quiet shockwave through the AI world

Nvidia-backed stock sends a quiet shockwave through the AI world originally appeared on TheStreet.

CoreWeave (CRWV) is the Nvidia (NVDA) -backed AI stock that’s been one of the biggest winners on Wall Street this year.

What started as a crypto side hustle was the best-performing AI tech IPO of 2025, up four times since its March debut.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter💰💵

Moreover, its power-packed alliance with Nvidia means it gets access to the hottest GPUs first, a key differentiator as everyone scrambles for AI computing.

Now, with July 3's headline-grabbing move in the books, this Nvidia-backed AI stock is showing just how it plans to scale up while shaking up the cloud hierarchy in the process.

How CoreWeave became an AI rocket ship

Starting as a crypto mining outfit, CoreWeave is now one of the buzziest names in the AI gold rush.

Launched in 2017 as Atlantic Crypto, the New Jersey business rode the incredible Ethereum wave before pulling back sharply a couple of years later.

It then rebranded and leaned hard into building out GPU-packed data centers, right when the generative AI boom was catching fire.

Fast-forward to today: CoreWeave runs dozens of tailor-made data centers across the U.S. and Europe, offering plug-and-play access to Nvidia’s hottest GPUs.

The big-ticket customers can sidestep the need to build in-house hardware fortresses by renting CoreWeave’s racks for their model training and inference needs.

Related: Google’s quiet AI win spells trouble for Amazon

Coreweave’s big competitive edge is its tight partnership with Nvidia, which owns roughly 5% of CoreWeave, funneling its cutting-edge GPUs to the upstart first.

No wonder Mr.Market has noticed.

CoreWeave’s IPO in March has been 2025’s biggest tech story, pricing at $40 per share and raising about $1.5 billion. Since then, its stock has skyrocketed over 270%, peaking above $166 in June.

Behind that surge is serious financial traction.

In the first quarter, CoreWeave brought in $981.6 million in sales, comfortably beating Wall Street’s $852.9 million estimate.

More Tech Stock News:

-

Analyst reboots IonQ stock price target for surprising reason

-

Apple could make big change to Siri, delight fans

-

Veteran analyst issues big Broadcom call, shakes up AI stock race

It’s sitting on a massive $25.9 billion revenue backlog, expecting to post full-year sales of $4.9 billion to $5.1 billion, beating analyst calls near $4.6 billion.

Specifically, its massive five-year, $11.9 billion contract with OpenAI (plus an extension) and its new role supporting Google Cloud’s compute push have caught the tech world’s attention.

Story ContinuesAlso, CoreWeave plans to spend more than $23 billion this year on new facilities as it doubles down on its generative AI bet.

CoreWeave’s big Nvidia play sends a message

CoreWeave just fired a massive shot across the hyperscaler battlefield, and Wall Street took notice.

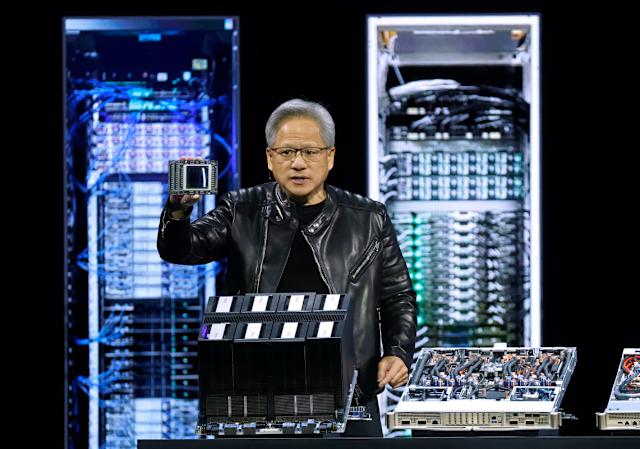

The AI cloud player is first to the party, rolling out the highly anticipated Nvidia GB300 NVL72. This powerful liquid-cooled, rack-scale AI juggernaut is built to train the most advanced models on the planet.

For investors, this is far from being a usual hardware upgrade.

It’s a clear sign that CoreWeave is punching above its weight as it stamps its authority in the hotly competitive AI arms race.

The stock’s 9% pop on July 3 says plenty about how Wall Street sees this move.

Related: Veteran analyst drops bold new call on Nvidia stock

Tech heads, take note that the NVL72 runs on Nvidia’s robust Blackwell chips, stuffing 72 Blackwell Ultra GPUs and 36 Arm Grace CPUs into Dell’s custom-built rack system.

That essentially translates into a system that’s 10 times faster in responsiveness and five times quicker than its predecessor.

That’s no less than a game-changer for businesses training multi-trillion parameter models, the same level of AI that will push the pace on the next wave of chatbots and agentic AI.

Being first means CoreWeave gets early bragging rights and a likely bump in real-world client workloads.

For its godfather in Nvidia, it clearly shows that the Blackwell ecosystem is hitting real-world racks, powering next-gen AI tech.

Moreover, Nvidia partners like Dell and Supermicro are also riding the Blackwell wave. Supermicro just showed off 30 enterprise AI solutions built on the same tech for the European market as it looks to dominate global AI factories.

Related: Veteran analyst offers eye-popping Nvidia, Microsoft stock prediction

Nvidia-backed stock sends a quiet shockwave through the AI world first appeared on TheStreet on Jul 5, 2025

This story was originally reported by TheStreet on Jul 5, 2025, where it first appeared.