The White House just took its most aggressive stance yet against Jerome Powell

The Trump administration’s intensifying campaign against Federal Reserve Chair Jerome Powell hit a boiling point Thursday.

Just two weeks after President Donald Trump sent a handwritten letter to Powell demanding lower interest rates, Russell Vought, Trump’s director of the Office of Management and Budget (OMB), accused Powell of breaking the law by failing to comply with government oversight regulations and lying to Congress about details of an approximately $2.5 billion planned renovation of the Fed’s headquarters.

“The President is extremely troubled by your management of the Federal Reserve System,” Vought wrote in a letter he posted to social media Thursday. “Instead of attempting to right the Fed’s fiscal ship, you have plowed ahead with an ostentatious overhaul of your Washington D.C. headquarters.”

For months, Trump has berated Powell, whom he appointed during his first term, and called him insulting names. The president has lately taken to calling Powell by the nickname “Too Late” for failing to recognize the 2022 inflation crisis fast enough and failing to slash interest rates as inflation has cooled down. Earlier this month, Trump suggested that Powell should resign in a social media post.

While some central banks, such as the European Central Bank and the Bank of Mexico, have lowered their benchmark lending rate a few times this year, the Fed has not. One big reason for that is the major policy shifts since Trump took office. Officials have said they want to see how those changes affect the economy first before considering further rate cuts.

Powell for his part has avoided responding to Trump’s harsh criticism, noting that the Fed is only focused on successfully taming inflation and preserving the labor market’s health.

CNN has reached out to the Federal Reserve for comment.

Laying the groundwork for firing “for cause”?

The latest criticism about the rising costs of the Fed’s headquarters may signal the administration is laying the groundwork to justify firing Powell, said Ed Mills, a policy analyst at Raymond James.

“The Supreme Court has made it very clear in their rulings that they would not support the president firing Powell,” Mills said. “So they can either find a reason to fire him for cause, or you create enough of a negative environment that Powell says, ‘it’s no longer worth it, I’m out.’”

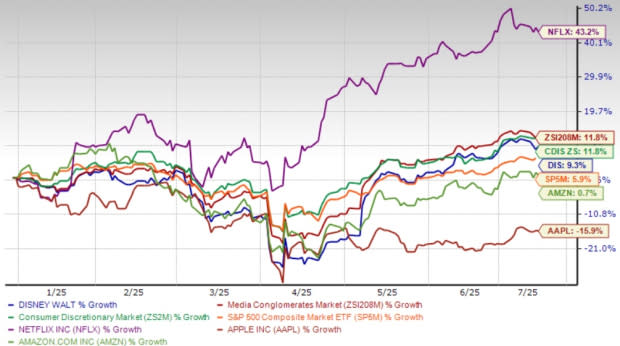

However, firing Powell could send financial markets reeling: Mills warned that markets would not respond well to any indication that Powell, or another Fed chair, had lost their independence and was under the control of the president.

Story Continues“I do think this could have the opposite impact of what they think it could,” Mills said. “If markets lose faith in the independence of the Fed, rates don’t go lower, they go higher.”

So the latest missive may instead be an effort to undermine Powell and turn sentiment against him.

Vought isn’t the only Trump administration official to slam Powell recently. In the past two weeks, Peter Navarro, the senior counselor for trade and manufacturing, wrote an op-ed calling Powell one of the worst Fed chairs in history; and Bill Pulte, head of the Federal Housing Finance Agency, called on Congress to investigate Powell.

“They are trying to pressure him in every way they can to resign,” said Alan Blinder, a former Fed vice chair, of Powell. “I don’t believe he will and I don’t believe he should.”

The move on Powell was not limited to a letter. A source familiar with the matter told CNN that Trump ousted three members of the National Capital Planning Commission, the federal government’s central planning agency for the region, which would have an oversight role in the Federal Reserve renovation project, and replaced them with loyalists: White House Secretary Will Scharf, Deputy Chief of Staff James Blair and Office of Management and Budget analyst Stuart Levenbach.

After a commission meeting on Thursday, Blair told CNN in an interview he was “concerned that the Federal Reserve renovation project’s execution is not in alignment with the plans submitted to and approved by the national capital planning commission,” echoing concerns OMB had raised in the letter.

Blair also said that he was requesting a full set of current plans and all amendments to the plans since submission to and approval by the NCPC in 2021 as well as a site visit.

“The project is either out of alignment with the plans originally submitted and approved, or Chair Powell was dishonest with the Senate Banking Committee in testimony on 6/25. One of two things has to be true,” Blair said. When asked what next steps would be if the commission found that Powell had lied, Blair said “it would be extremely concerning and demonstrate a casual disregard for the law and good sense. I don’t know that he was dishonest. But it is a knowable fact.”

A White House official told CNN that the president’s frequent attacks on Powell are Trump’s way of venting his frustrations about the Fed chair. The official also said OMB’s decision to open an investigation is not a way to lay the groundwork for Powell’s firing.

“I am not aware of a broader scheme to use that as a way to push Powell out,” the official said.

Renovation controversy

Powell’s critics have increasingly raised concerns about a planned renovation of the central bank’s office buildings and Powell’s recent testimony to Congress about the construction work.

The cost estimate for those projects swelled to $2.5 billion this year, compared to earlier plans that said it would cost $1.9 billion. A 2023 Fed budget document attributed some of the additional cost to “significant increases in raw materials… higher labor costs, and changes in construction schedule expectations which lengthen use of leased space.”

While testifying before the Senate in June, Powell pushed back on criticism that the remodeling was excessive, saying, “there’s no VIP dining room, there’s no new marble… there are no special elevators, just old elevators that have been there.”

Vought accused Powell of lying in his testimony and said the Fed’s renovation did not comply with federal oversight regulations. However, the Federal Reserve has its own budget and set of rules, separate from the federal government’s.

Tariffs may play a role

President Trump has made it clear that he prefers a Fed chair who will lower interest rates, but the Fed hasn’t voted to cut rates since December.

Trump and his allies have said the Fed’s decision to keep rates steady is politically motivated, but Powell has signaled Trump’s tariff policy – and its potential to stoke inflation – have played a role.

When asked earlier this month whether the Fed would have cut rates by now if it weren’t for significant policy changes by the Trump administration, Powell responded, “I do think that’s right.”

However, Powell also noted that a majority of Fed officials to expect they will reduce rates later this year.

That may not be soon enough for Trump. Last month, Trump said he may announce his pick to succeed Powell, whose term ends in May 2026, “very soon.”

Even without firing Powell outright, such a move could undermine the markets’ confidence in the Fed, said Blinder, especially if the incoming chair pledges to lower interest rates.

“One obvious effect is it could raise inflationary expectations, meaning the market will raise interest rates,” Blinder said. “I think it could be a way for the president of the United States to push monetary policy.”

CNN’s Phil Mattingly, Matt Egan, Alayna Treene and Bryan Mena contributed to reporting.

This story has been updated with additional context and developments.

For more CNN news and newsletters create an account at CNN.com