Long regarded as a pioneer in card-based payments, Visa Inc. V is currently navigating a market where smartphones are taking over, and physical wallets are becoming less common. Customers are adopting digital wallets that hold everything from credit cards to cryptocurrency assets, from tap-to-pay at nearby establishments to biometric authentication in smartphone apps.

To achieve this, V has quickly adapted its digital strategy. Its Visa Token Service replaces sensitive card information with secured tokens, facilitating transactions for platforms like Apple Pay and Google Pay. By integrating itself into the backend of digital wallets, the company stays relevant even when physical cards are out of the picture. Visa’s processed transactions grew 9% year over year in the second quarter of fiscal 2025.

Visa is also stepping up in the cryptocurrency world by teaming up with various crypto platforms, rolling out crypto-linked Visa cards and looking into stablecoin transactions on blockchain networks. This move reflects its effort to stay relevant as the landscape of money continues to change. The company’s extensive reach is a game changer. With its massive acceptance network and collaborations with fintech, neobanks and major tech companies, V is in a position to adapt and thrive.

The challenge lies in staying essential in a world where people may skip traditional card networks entirely, opting instead for real-time payments or decentralized systems. In this wallet-driven and crypto-curious age, the company’s future hinges on evolving beyond just being a card company. Keeping that competitive edge will require ongoing innovations and investments.

How Are Competitors Faring?

Some of V’s competitors in the digital wallet space include Mastercard Incorporated MA and PayPal Holdings, Inc. PYPL.

Mastercard is in a race with Visa when it comes to embracing digital wallets and other alternative payment options. Mastercard has invested significant resources in tokenization and contactless payments to stay ahead of the market. It is focused on staying embedded in the background of digital wallet ecosystems instead of competing directly with them.

PayPal is operating its own digital wallet, with features like PayPal Checkout, Venmo and even crypto trading within the app. PayPal directly connects with users instead of operating behind the scenes. Additionally, it is making a push into in-store payments with QR codes and contactless options.

Visa’s Price Performance, Valuation & Estimates

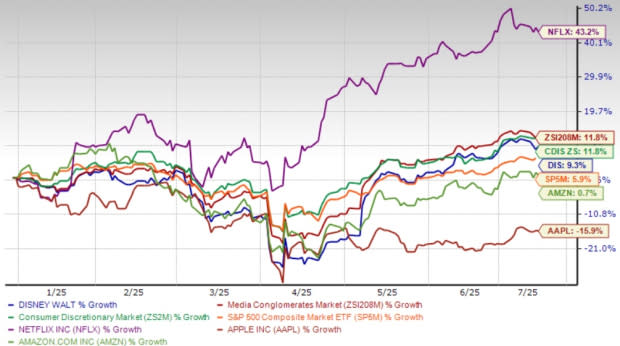

Shares of Visa have jumped 13.2% in the year-to-date period compared with the 5.4% growth of the industry.

Leer más

Image Source: Zacks Investment Research

From a valuation standpoint, V trades at a forward price-to-earnings ratio of 28.76, above the industry average of 22.76.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Visa’s fiscal 2025 earnings implies a 12.9% jump from the year-ago period.

Image Source: Zacks Investment Research

Visa stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research