Amcor Boosts PCR Capabilities With Latest Investment in Kentucky

Amcor Plc AMCR announced that it is investing in its Nicholasville, KY facility to boost post-consumer recycled (‘PCR’) packaging production capabilities. This move will support Amcor customers’ varied PCR needs.

Benefits of Amcor’s Investment

AMCR's new system features dedicated silos that supply multiple production lines. This will allow for precise PCR blending and give customers the flexibility to choose their desired PCR percentage, up to 100%. This innovation showcases Amcor's ability to optimize manufacturing and increase the use of recycled materials in packaging.

While the investment was initially made to cater to Amcor’s spirits customers’ specific needs, it will support customers in healthcare, food, and home and personal care segments.

The facility aligns with customers’ sustainability goals by providing them more choices for the recycled content levels of their packaging. This strengthens Amcor’s commitment to a circular economy.

Amcor’s rigid packaging business has previously collaborated with customers to introduce more PCR-based packaging solutions. This resulted in a significant increase of more than 50,000 metric tons in PCR polymer purchases in fiscal 2024 from the prior year. With growing legislation mandating minimum recycled content, Amcor's advanced PCR capabilities can help brands meet compliance requirements, promote recycling and support a circular economy.

AMCR’s Q3 Performance

Amcor reported third-quarter fiscal 2025 (ended March 31, 2025) adjusted earnings per share (EPS) of 18 cents, in line with the Zacks Consensus Estimate as well as the year-ago quarter’s reported figure. Amcor has also closed the merger with Berry Global Group, Inc., strengthening its position as a global leader in consumer and healthcare packaging solutions.

Amcor’s revenues dipped 2.3% year over year to $3.33 billion. The top line missed the Zacks Consensus Estimate of $3.49 billion.

While volumes were in line with last year, the price/mix contributed slightly positively to net sales. The overall decline was attributed to the unfavorable impacts of approximately 2% related to foreign exchange rates and a 1% negative impact of items affecting comparability, which were offset by a favorable impact of around 1% associated with the pass-through of higher raw material costs.

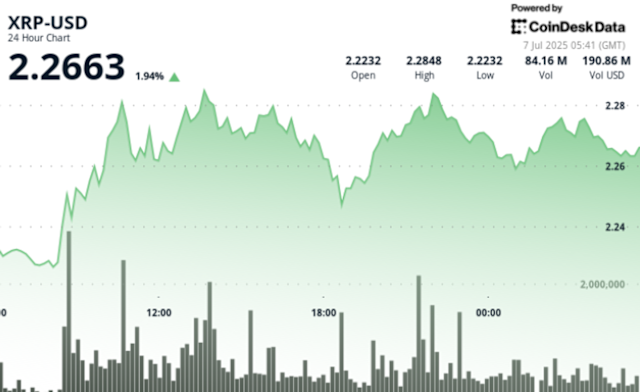

Amcor’s Stock Price Performance

In the past year, AMCR shares have gained 5.1% compared with the industry’s 2% increase.

Image Source: Zacks Investment Research

AMCR’s Zacks Rank & Other Stocks to Consider

Amcor currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the Industrial Products sector are Life360, Inc. LIF, IHI Corporation IHICY and Federal Signal Corporation FSS. LIF and IHICY sport a Zacks Rank #1 (Strong Buy), and FSS has a Zacks Rank #2 at present. You can see the complete list of today's Zacks #1 Rank stocks here.

Life360 delivered an average trailing four-quarter earnings surprise of 415%. The Zacks Consensus Estimate for LIF’s 2025 earnings is pinned at 24 cents per share, which indicates a year-over-year upsurge of 500%. Life360’s shares have soared 117.3% in a year.

The Zacks Consensus Estimate for IHI Corp’s 2025 earnings is pegged at $1.26 per share, indicating a year-over-year increase of 3.8%. IHI Corp’s shares have skyrocketed 304.3% in a year.

Federal Signal delivered an average trailing four-quarter earnings surprise of 6.4%. The Zacks Consensus Estimate for FSS’s 2025 earnings is pinned at $3.83 per share, which indicates year-over-year growth of 14.6%. The company’s shares have gained 18.9% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Federal Signal Corporation (FSS) : Free Stock Analysis Report

IHI CORP (IHICY) : Free Stock Analysis Report

Amcor PLC (AMCR) : Free Stock Analysis Report

Life360, Inc. (LIF) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research